In the dynamic world of final expense insurance leads, the ability to follow up effectively can make the difference between a potential lead and a satisfied client. Mastering the art of follow-up is crucial for insurance agents looking to increase conversion rates and build lasting relationships. In this comprehensive guide, we will explore the process of strategic follow-up and provide valuable tips on how to secure leads for final expense insurance business.

Importance of Follow-Up in Final Expense Insurance Leads:

Following up goes beyond the initial contact; it’s about nurturing relationships and building trust with potential clients. In the world of final expense insurance, where sensitivity and empathy play a significant role, thoughtful follow-up can significantly impact conversion rates. It reassures leads, addresses concerns, and demonstrates your commitment to their needs.

How To Get Leads For Final Expense Insurance: Follow-Up Guide

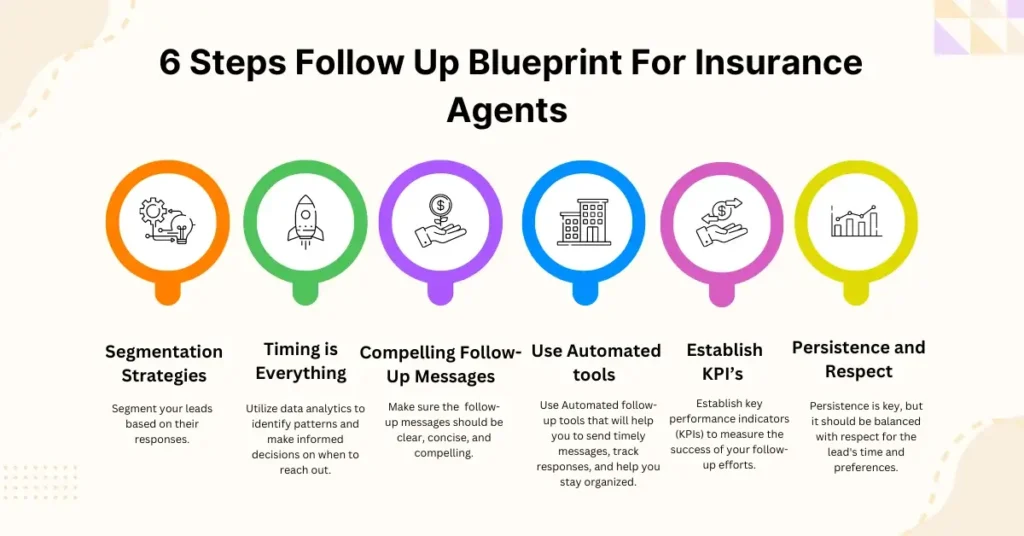

1. Segmentation Strategies: Tailoring Your Approach:

One size doesn’t fit all when it comes to follow-up. Segment your leads based on their responses, preferences, and timelines. This allows you to tailor your follow-up messages and offers a more personalized experience, increasing the likelihood of conversion (turning leads into customers).

2. Timing is Everything: The Best Times to Follow Up:

Understanding the optimal timing for follow-up is crucial. Whether it’s a phone call, email, or a personalized message, being aware of your leads’ preferred communication times enhances the chances of engagement. Utilize data analytics to identify patterns and make informed decisions on when to reach out.

3. Crafting Compelling Follow-Up Messages:

Your follow-up messages should be clear, concise, and compelling. Address any leads’ concerns, emphasize the value of your final expense insurance offerings, and provide a call to action. Use language that resonates with empathy and understanding.

4. Utilizing Technology: Automated Follow-Up Tools:

Take advantage of technology to streamline your follow-up process. Automated follow-up tools can send timely messages, track responses, and help you stay organized. This allows you to focus on building relationships while technology handles the logistics.

5. Measuring Success: Key Metrics for Evaluation:

Establish key performance indicators (KPIs) to measure the success of your follow-up efforts. Track metrics such as response rates, conversion rates, and client feedback. Analyzing these metrics provides insights into what works and helps you refine your approach over time.

6. Balancing Persistence and Respect: Follow-Up Etiquette:

Persistence is key, but it should be balanced with respect for the lead’s time and preferences. Avoid excessive or intrusive follow-up, as it can have the opposite effect. Aim for a follow-up frequency that is considerate and respectful.

Conclusion:

Mastering the art of follow-up is an ongoing process that requires a combination of empathy, strategic thinking, and the right tools. By understanding the unique needs of your final expense insurance leads and implementing efficient follow-up strategies, you can increase conversion rates, build trust, and ultimately create a positive experience for your clients. Remember, successful follow-up is not just about closing a sale; it’s about fostering long-term relationships in the sensitive realm of final expense insurance.