Key Takeaways:

- Final Expense Insurance provides a smaller death benefit designed to cover funeral and burial costs, with affordable premiums and guaranteed acceptance.

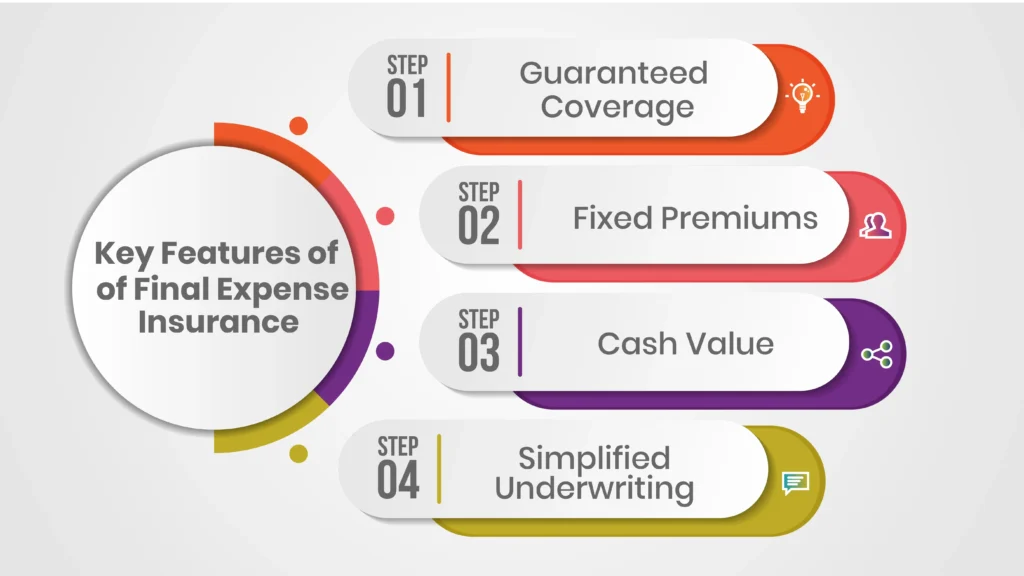

- Key Features include fixed premiums, cash value accumulation, and simplified underwriting, making it ideal for seniors.

- Family Funeral Insurance is a type of final expense insurance that offers coverage for multiple family members, ensuring broader protection.

- Family Funeral Insurance provides customizable options, simplified qualification processes, and cost-effective plans for covering entire families.

- Generating Final Expense Leads is critical for insurance agents, and can be achieved through a mix of telemarketing, online marketing, direct mail, and referrals.

- Peace of Mind is the ultimate benefit of both final expense and family funeral insurance, offering financial relief for loved ones during difficult times.

Funeral insurance, burial insurance also known as “final expense insurance” is an important type of life insurance that is designed to cater for costs incurred during burial. This kind of insurance is most appreciated by pensioners who care for their families and wish to save them from financial difficulties after a person’s death.

This article will elucidate the knowledge gap of last expense insurance which also includes the differences between life insurance and burial insurance, the importance of final expense leads, ways how to generate these leads, and reasons why consumers and insurance professionals need to have an adequate understanding of this insurance type.

Table of Contents

What Is Final Expense Insurance?

Final expense insurance is a whole life insurance policy with a smaller death benefit, typically from $1,000 to $25,000. Unlike traditional life insurance policies, which can have higher death benefits and more complex structures, burial insurance is designed to be simple. The primary purpose of this insurance is to cover the costs of a funeral, burial, cremation, or other related expenses that arise after the policyholder’s death.

Key Features of Final Expense Insurance:

- Guaranteed Coverage: Most final expense policies offer guaranteed acceptance, meaning that individuals cannot be denied coverage based on their health or age, although premiums may vary.

- Fixed Premiums: The premiums for last expense insurance remain level throughout the policy’s life, making it easier for policyholders to budget.

- Cash Value: Like other whole life insurance policies, final expense insurance accumulates a cash value over time that the policyholder can borrow against if needed.

- Simplified Underwriting: Many final expense policies do not require a medical exam, and the application process typically involves answering a few health-related questions.

Benefits of Last Expense Insurance:

Burial expense insurance has several benefits which are listed below.

- Peace of Mind: The primary benefit of final expense insurance is the peace of mind it provides to policyholders. Knowing that their loved ones won’t have to bear the financial burden of funeral expenses allows individuals to focus on other aspects of end-of-life planning.

- Affordable Premiums: Final expense insurance policies generally have lower premiums than traditional life insurance policies because of the lower coverage amounts. This makes it an affordable option for seniors on a fixed income.

- Guaranteed Acceptance: Qualifying for traditional life insurance can be challenging for many seniors with health issues. Final expense insurance typically offers guaranteed acceptance, ensuring that everyone can obtain some level of coverage.

- No Medical Exam Required: Simplified underwriting means that most policies do not require a medical exam, making it easier and quicker to obtain coverage.

- Cash Value Accumulation: Over time, the policy builds cash value, which can be borrowed against if the policyholder faces unexpected financial needs.

- Flexibility: The death benefit from a final expense insurance policy can be used to cover any costs, not just funeral expenses. This could include outstanding medical bills, debts, or even a gift to a beneficiary.

Drawbacks of Final Expense Insurance:

Along with the benefits, the final expense insurance also has some drawbacks.

- Limited Coverage: The death benefit of final expense insurance is typically lower than that of traditional life insurance policies. While it is sufficient to cover funeral costs, it may not provide enough support for other financial needs, such as paying off a mortgage or supporting a dependent.

- Higher Cost Per Dollar of Coverage: Compared to term life insurance, final expense insurance can be more expensive per dollar, especially for younger, healthier individuals who may qualify for lower-cost term policies.

- Potential for Overinsurance: Some individuals may already have sufficient savings or other insurance policies to cover final expenses, making additional coverage unnecessary.

- Cash Value Borrowing Costs: While the cash value feature is beneficial, borrowing against it reduces the death benefit and may incur interest charges, diminishing the policy’s overall value.

While final expense insurance offers significant benefits, some individuals may want additional flexibility or coverage for their entire family, which leads us to explore family funeral insurance, a specialized option that expands on the concept of final expense insurance.

Family Funeral Insurance:

While family funeral insurance is often used interchangeably with final expense insurance, it offers a more targeted approach to covering the costs associated with multiple family members’ funerals. Family funeral insurance allows you to extend coverage beyond the policyholder, offering financial protection for the entire family, and making it a crucial option for families wanting to ensure all funeral costs are covered.

How Family Funeral Insurance Relates To Final Expense Insurance:

- Scope of Coverage: While final expense insurance generally focuses on covering funeral and burial costs for an individual, family funeral insurance is designed to offer flexibility, ensuring that multiple family members are covered under one policy. This can provide comprehensive financial security for funeral costs within a family.

- Customizable Options: Many family funeral insurance policies allow you to customize the level of coverage depending on the number of family members included. This feature makes it a distinct but closely related product to final expense insurance.

- Simplified Process: Similar to final expense insurance, family funeral insurance typically features simplified underwriting, allowing for easy qualification without a medical exam and often with guaranteed acceptance.

- Cost-Effective for Families: Families who may not want to purchase individual final expense insurance policies for each member can save money with a family funeral insurance plan, which bundles coverage into one policy.

Adding a family funeral insurance option alongside or as part of a final expense policy is a great way for consumers to safeguard their family’s financial future during difficult times. For insurance agents, understanding this niche can open up new opportunities in the senior insurance market.

What Are Final Expense Leads?

Final expense leads are individuals who have shown interest in purchasing final expense insurance. These leads are critical for insurance agents and companies as they represent potential customers who are likely to purchase a policy. Generating and converting these leads is a major focus for businesses that sell final expense insurance.

Types of Final Expense Leads:

- Exclusive Leads: These leads are sold to only one agent or agency, ensuring exclusivity and reducing competition.

- Shared Leads: These leads are sold to multiple agents or agencies, leading to increased competition but at a lower cost.

- Aged Leads: Older leads that may have already been contacted or have expressed interest some time ago. These are less expensive but can be harder to convert.im

- Telemarketing Leads: Generated through outbound calls to potential customers who may be interested in burial expense insurance.

- Internet Leads: Individuals who have expressed interest online, often by filling out a form or responding to an advertisement.

- Direct Mail Leads: Generated through traditional mail campaigns where potential customers respond to an offer by returning a reply card or calling a phone number.

Strategies To Generate Final Expense Leads:

Generating high-quality final expense leads requires a combination of traditional and modern marketing techniques. Here are some effective strategies:

1. Telemarketing Campaigns:

Utilize a dedicated call center to reach out to potential customers directly. This approach allows for personal interaction, which is particularly effective in building trust with seniors.

2. Online Marketing and Digital Advertising:

Leverage SEO, PPC, and social media marketing to reach potential customers online. Optimize your website for relevant keywords and use targeted ads to attract seniors or their families.

3. Direct Mail Campaigns:

Send personalized mailers to seniors, highlighting the benefits of last-expense insurance. Include a clear call-to-action, such as a toll-free number or reply card.

4. Referral Programs:

Encourage existing clients to refer friends and family by offering incentives. Word-of-mouth is a powerful tool, especially in the senior market.

5. Community Engagement and Events:

Participate in local events, senior expos, and health fairs. Set up informational booths and offer free consultations to attract leads.

6. Lead Purchase and Aggregators:

Purchase leads from reputable lead generation companies. Ensure the leads are exclusive or fresh to improve conversion rates.

7. Content Marketing and Education:

Create educational content that addresses common questions and concerns about whole life insurance. Distribute this content through your website, blog, social media, and email newsletters.

Conclusion:

Final expense insurance is an essential product for many seniors, offering peace of mind and financial security for their loved ones. Family funeral insurance, a specific type of final expense insurance, extends this protection to entire families, making it an ideal choice for those looking to cover multiple funeral costs with one policy.

While both products share similar benefits, such as affordable premiums, guaranteed acceptance, and no medical exam requirements, family funeral insurance goes a step further by providing coverage for the entire family, ensuring that no loved one is left financially burdened by funeral expenses.

For insurance agents, generating high-quality final expense and family funeral insurance leads is crucial for success. By employing a mix of traditional and digital marketing strategies, agents can effectively reach their target audience, build trust, and ultimately convert leads into loyal customers.

Understanding the nuances of final expense insurance and family funeral insurance will enable insurance professionals to better serve their clients while growing their businesses.