In 2024, the final expense insurance market is projected to reach approximately $188.26 billion, with expectations to grow at a CAGR of 7.1% between 2024 and 2032, potentially reaching $350.44 billion by 2032. This growth underscores the increasing demand for effective lead generation strategies, such as live transfer final expense leads, to capitalize on emerging opportunities.

In this article, we will deep dive in live transfers final expense leads, what they are and how to generate them.

Let’s get started:

Key Takeaways:

- Higher Conversion Rates: Live transfer final expense leads connect agents with pre-qualified prospects, enhancing the likelihood of successful sales.

- Immediate Engagement: Real-time connections allow agents to address prospects’ needs promptly, improving customer satisfaction.

- Personalized Sales Approach: Direct interactions enable tailored communication, fostering trust and rapport with potential clients.

- Efficient Resource Utilization: By focusing on interested prospects, agents can allocate time and resources more effectively, leading to better ROI.

- Scalability: The streamlined process allows sales teams to manage higher lead volumes without compromising quality.

Table of Contents

What Are Live Transfer Final Expense Leads?

Live transfer final expense leads are pre-qualified, real-time prospects directly connected to sales agents via phone. These leads have expressed immediate interest in final expense insurance, facilitating prompt engagement and higher conversion potential.

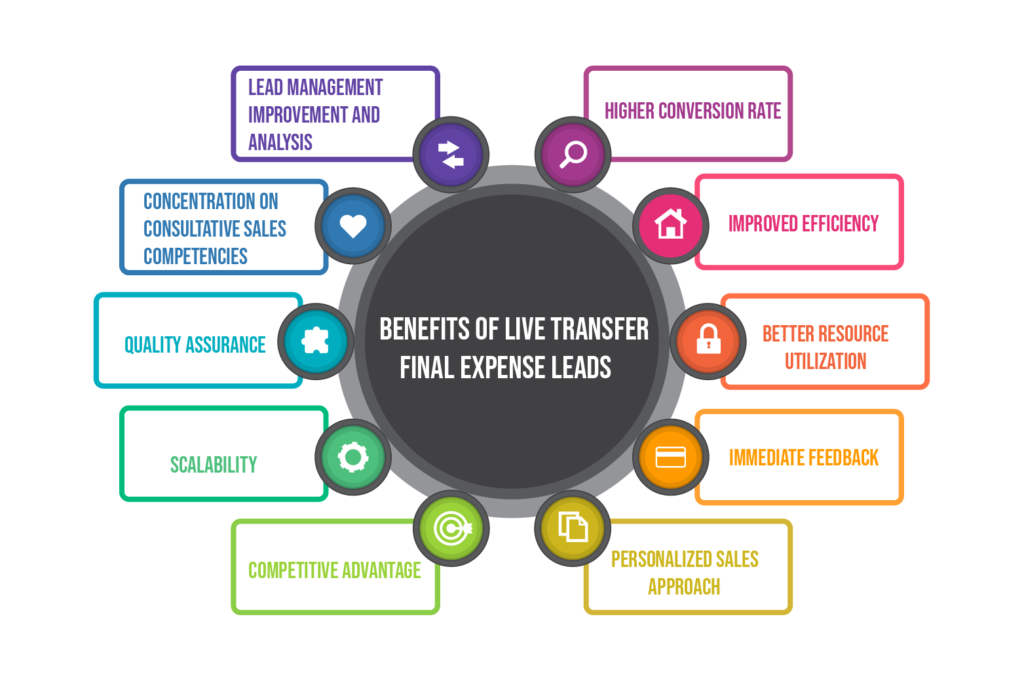

Benefits of Live Transfer Final Expense Leads:

Live transfer final expense leads offer numerous advantages that can significantly enhance your insurance sales process.

Here are some of the key benefits:

1. Higher Conversion Rates:

- Pre-Qualified Leads: None of the leads sold as ‘live transfer’ leads are cold; the prospects already exhibit an obvious interest in final expense insurance. This makes them more able to be converted as opposed to random leads.

- Immediate Engagement: When the prospect is handed over to your sales team, his interest level is as high as it can get which increases the probability of the sale.

2. Improved Efficiency:

- Reduced Time on Cold Calling: Sales leads by live transfer thereby cutting down the time your team has to waste on cold calling or even qualifying the leads.

- Streamlined Process: The lead is immediately passed to a sales agent in the process and this has cut down the number of processes involved in the sale.

3. Better Resource Utilization:

- Cost-Effective: Nevertheless, regarding the live transfer leads, even if the cost per lead is higher, the lead conversion rates are considerably higher, and, therefore, more cost-efficient throughout the time not to mention the time wasted on unqualified leads.

- Higher ROI: These decisions lead to enhanced resource allocation and improved opportunities for sales, which in turn lead to a higher return on investments.

4. Immediate Feedback:

- Real-Time Interaction: This means that the sales agents can easily be able to tell how interested a prospect is, and this will enable the sales agents to be able to address these concerns almost instantly which can easily translate to faster decision-making.

- Opportunity for Instant Objection Handling: In the case of a prospect who may have objections or questions, the agent should be in a position to solve the issues instantly thus making the prospect more likely to make the sale.

5. Personalized Sales Approach:

- Tailored Communication: This means that since the lead is already interested, agents have to work on the aspect of detailing, which addresses the individual issues of a prospect.

- Enhanced Customer Experience: It is always important to have direct interaction with customers to provide them with the best possible customer service and thus enhance their loyalty.

6. Competitive Advantage:

- Exclusivity: Often, live transfer leads are not shared with multiple agents, reducing competition and giving you a better chance to close the sale.

- First-Mover Advantage: Being the first to speak with a prospect who is ready to buy can give you a significant advantage over competitors using other types of leads.

7. Scalability:

- Handling Higher Volumes: Since the process is more streamlined and efficient, your sales team can handle a higher volume of leads, leading to increased sales opportunities.

- Adaptable to Growth: As your business grows, live transfer leads can be scaled to meet the increased demand without compromising on lead quality.

8. Quality Assurance:

- Lead Verification: Almost all the companies that undertake the offering of live transfer leads to conduct a quality check of the prospect before connecting him/her to an agent to ensure they only get serious customers seeking final expense insurance.

- Consistent Lead Quality: The fact that leads from live transfers are usually of good quality, assists in keeping a constant flow of sales, enabling organizations to predict and strategies for future developments.

9. Concentration on Consultative Sales Competencies:

- Maximizes Sales Skills: In essence, since your sales team is relieved of the task of cold calling and lead qualification, then you are free to allow the sales team to do what they do best: closing sales.

- Reduced Stress: If there are fewer cold calls and unqualified leads, it will relieve the pressure on the sales agents thus enhancing their morale and productivity.

10. Improved Lead Management, Tracking, and Analysis:

- Better Data for Optimization: Live transfer leads hence can easily be accompanied by necessary tracking of issues such as conversion rates, and time to close among other aspects of lead source. These are useful in making the necessary alterations to your selling strategies.

- Informed Decision-Making: The information involved in live transfer leads can be dissected and analyzed by sales managers to help improve overall business strategy in the future.

Comparing Live Transfer Final Expense Leads To Other Lead Types:

1. Traditional Leads:

Traditional leads typically come from a variety of sources such as online forms, direct mail responses, or purchased lead lists. While these leads can be valuable, they often require significant time and effort to qualify and convert. Sales teams must engage in cold calling, follow-ups, and multiple touch-points before securing a sale.

2. Shared Leads:

Shared leads are sold to multiple agents or companies. While they can be less expensive, the competition for these leads is fierce. Prospects might receive calls from multiple agents, leading to frustration and decreased conversion rates. Shared leads can also lead to a race to the bottom in terms of pricing, eroding potential profit margins.

3. Exclusive Leads:

Exclusive leads are sold to only one agent or company, ensuring that the prospect is not bombarded with multiple sales calls. While these leads are more targeted and can have higher conversion rates than shared leads, they still require initial outreach and qualification efforts.

Integrating Live Transfer Leads Into Your Sales Strategy:

1. Leading Generation Partners:

Choose partners with expertise in the final expense insurance market, proven lead acquisition processes, and efficient transfer mechanisms to your sales team.

2. Training of Sales Staff:

Equip your sales team to effectively handle live transfer leads by focusing on:

- Value Presentation: Ensure agents can clearly articulate the benefits of your final expense insurance products.

- Building Rapport: Teach agents to quickly establish a connection with prospects.

- Needs Assessment: Train agents to identify and address the specific needs of each prospect.

3. Building a Strong Follow-up Plan:

Not all prospects will commit during the initial call. Implement a structured follow-up strategy that includes:

- Scheduled Callbacks: Arrange future calls at convenient times for the prospect.

- Personalized Emails: Send tailored emails addressing the prospect’s specific concerns.

- Informative Materials: Provide brochures or links to relevant articles to assist in decision-making.

Consistent follow-up demonstrates commitment and keeps your services top-of-mind for the prospect.

4. Monitoring the Performance and Optimizing It:

Regularly assess the effectiveness of your live transfer lead strategy by tracking metrics such as:

- Cost per Acquisition: Calculate the total cost involved in acquiring each customer.

- Conversion Rates: Measure the percentage of leads that result in sales.

- Average Time to Close: Monitor the duration from initial contact to finalizing the sale.

Disadvantages of Final Expense Live Transfer Leads:

While beneficial, live transfer leads have potential drawbacks:

- Higher Cost: These leads can be more expensive than other types, though higher conversion rates may offset the cost.

- Scalability Challenges: Real-time engagement requires agents to be available to take calls, which can limit scalability for businesses with limited staff or resources.

- Dependence on Call Center Quality: The success of live transfer leads heavily relies on the quality of the call center generating them. Inconsistencies can lead to variability in lead quality.

How Much Do Live Transfer Leads Cost?

Live transfer leads for final expense insurance typically range from $55 to $90 per lead. Costs vary based on lead quality, call center reputation, and location, but higher conversion rates often justify the investment.

Tips For Maximizing Success With Final Expense Live Transfer Leads:

1. Be Prompt and Professional:

Answer calls immediately and courteously to maintain the prospect’s interest. Ensure your sales team is always prepared to engage effectively.

2. Personalize the Conversation:

Use information provided by the lead generation partner to tailor your approach, addressing the prospect by name and focusing on their specific needs.

3. Educate the Prospect on Benefits:

Highlight how your final expense insurance can provide peace of mind by covering end-of-life expenses, alleviating financial burdens on their family.

4. Handle Objections Gracefully:

Listen to the prospect’s concerns, acknowledge them, and provide clear, concise responses that address their objections.

5. Maintain Detailed Records:

Use a customer relationship management (CRM) system to document each interaction, including notes and follow-up actions, to ensure continuity and personalized engagement in future communications.

Conclusion – Live Transfer Final Expense Leads:

In the competitive landscape of final expense insurance sales, live transfer leads offer a strategic advantage by providing immediate, qualified prospects ready for engagement. By selecting reputable lead generation partners, training your sales team effectively, and implementing robust follow-up and performance monitoring strategies, you can maximize the benefits of live transfer leads, leading to higher conversion rates and a stronger return on investment.