In 2024, the final expense insurance market is projected to reach approximately $188.26 billion, with expectations to grow at a CAGR of 7.1% between 2024 and 2032, potentially reaching $350.44 billion by 2032. This significant growth underscores the importance of implementing effective ROI strategies for final expense leads to capitalize on the expanding market.

In this article, we’ll explore effective ROI strategies for final expense leads and how insurance agents and businesses can improve their lead conversion rates, lower their cost per acquisition (CPA), and ultimately boost profitability.

Read More: How To Qualify Final Expense Leads Without Wasting Resources

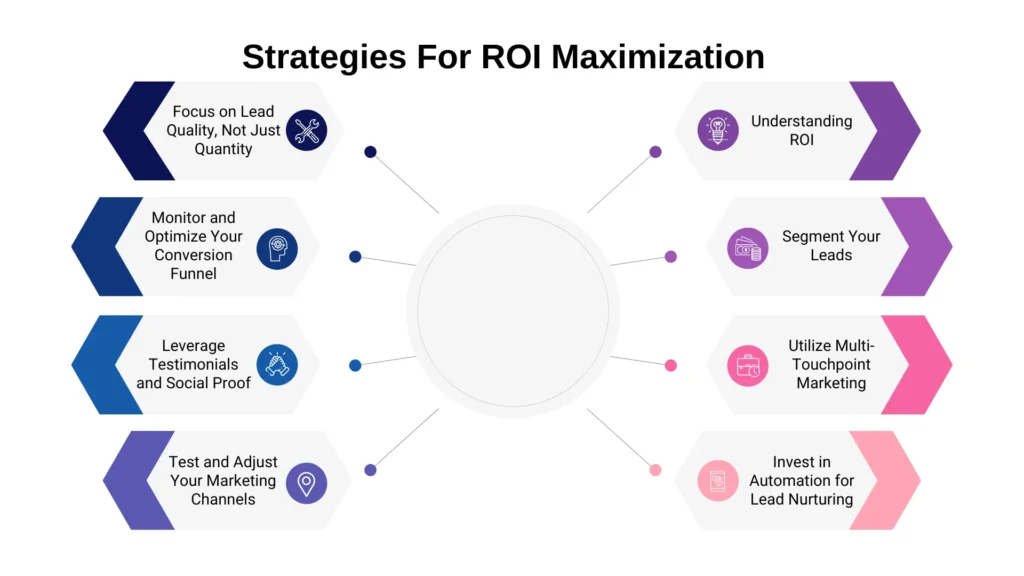

Key Takeaways:

- Segmenting leads enhances targeting and conversion rates by focusing on prospects most likely to purchase.

- Employing multi-touchpoint marketing engages prospects across various channels, increasing conversion likelihood.

- Utilizing marketing automation tools streamlines follow-up and lead nurturing, saving time and improving ROI.

- Prioritizing lead quality over quantity results in better conversions and a higher ROI.

- Monitoring and optimizing the sales funnel helps identify areas where leads drop off, allowing for necessary adjustments to improve performance.

- Leveraging testimonials and social proof builds trust with prospects, boosting the chance of converting hesitant leads into customers.

Table Of Contents:

ROI Strategies For Final Expense Leads: 8-Step Guide

1. Understanding ROI in Final Expense Lead Generation:

ROI is a key performance indicator for any marketing or lead generation campaign. In the context of final expense leads, ROI measures how much revenue is generated relative to the cost of acquiring those leads. To calculate ROI, use the following formula:

ROI=(Revenue−Cost of LeadsCost of Leads)×100, ROI=(Cost of LeadsRevenue−Cost of Leads)×100.

For example, if you spend $1,000 on leads and make $5,000 in sales, your ROI would be:

ROI=(5000−10001000)×100=400%, ROI=(10005000−1000)×100=400%.

A high ROI indicates that your lead generation efforts are effective and yield profitable results, while a low or negative ROI suggests that you need to reevaluate your ROI strategies.

2. Segment Your Leads For Better Targeting:

In ROI strategies for final expense leads, One of the most effective ways to improve the ROI of your final expense lead campaigns is by segmenting your leads. Not all leads are created equal, and segmenting them based on criteria like age, income, health status, and location can help you target the right audience. By focusing your efforts on leads most likely to convert, you can significantly improve your conversion rates and reduce wasted spending.

For instance, final expense insurance typically appeals to seniors over the age of 50, particularly those with lower or fixed incomes. Crafting tailored marketing messages for these demographics will resonate more deeply, increasing the likelihood of conversion.

3. Utilize Multi-Touchpoint Marketing:

Consumers rarely make purchase decisions after a single interaction. Multi-touchpoint marketing, which involves engaging with leads across multiple channels (email, phone, social media, and direct mail), can boost your ROI by nurturing leads through the sales funnel.

By consistently staying top-of-mind through different touchpoints, you can increase the likelihood of a lead converting into a sale. Combining outreach efforts such as email drip campaigns, follow-up calls, and retargeting ads is a proven way to maintain engagement with prospects and guide them toward a final decision.

4. Invest in Automation for Lead Nurturing:

Automation tools are invaluable for nurturing leads and improving ROI. By automating repetitive tasks such as sending follow-up emails or text messages, you can engage with your leads at the right moments without overwhelming your sales team. Marketing automation tools help you build personalized campaigns that cater to specific customer behaviors, ensuring that you stay in front of prospects throughout their decision-making process.

For example, if a lead fills out a form on your website but doesn’t make a purchase, you can automatically trigger a series of emails that provide more information, address concerns, and encourage further engagement. By using automation strategically, you can optimize each touchpoint and significantly improve your ROI.

5. Focus on Lead Quality, Not Just Quantity:

One of the most common mistakes in final expense lead generation is focusing too much on lead volume rather than lead quality. A high volume of low-quality leads can drive up your acquisition costs while delivering poor conversion rates. Instead, prioritize acquiring high-quality leads that have been vetted or pre-qualified. High-quality leads may cost more upfront but will yield higher returns in the long run due to better conversion rates.

For example, purchasing exclusive leads or leads generated through highly targeted digital marketing efforts will often result in higher conversion rates than buying shared or aged leads, which are often sold to multiple agents and may have lower engagement.

6. Monitor and Optimize Your Conversion Funnel:

Every business has a sales funnel, and understanding where leads drop off within your funnel is key to improving your ROI. For final expense insurance, the sales process typically involves generating interest, building trust, and guiding the customer to make a decision.

By analyzing your funnel at each stage (lead generation, initial contact, follow-up, and conversion), you can identify areas for improvement. For instance, if you notice that leads are not converting after the initial contact, you may need to refine your sales script, offer additional information, or address common objections earlier in the conversation.

Additionally, using analytics tools to monitor the performance of each stage of your funnel can help you optimize your approach and focus resources where they will have the greatest impact.

7. Leverage Testimonials and Social Proof:

Incorporating testimonials and social proof into your marketing efforts builds trust with prospects. Positive reviews and case studies from satisfied clients add credibility and can significantly boost conversion rates, especially for prospects who are undecided. Displaying these elements on your website, social media, or in email campaigns can reassure potential customers of the value of your services.

8. Test and Adjust Your Marketing Channels:

Continuous testing and adjustment of marketing channels are vital. Evaluate the performance of each channel including paid search, social media, direct mail, or cold calling, in terms of lead quality, conversion rates, and ROI. Reallocate resources to higher-performing channels as needed. For example, if direct mail campaigns yield better conversions than cold calls, increasing investment in direct mail can enhance ROI.

Conclusion – ROI Strategies For Final Expense Leads:

Maximizing the ROI Strategies For Final Expense Leads requires a combination of smart segmentation, multi-touchpoint marketing, automation, and a focus on lead quality. By continuously monitoring and optimizing your lead generation strategies, businesses can reduce costs, improve conversion rates, and achieve greater profitability in the final expense insurance market.

FAQ’s:

What are effective strategies to maximize ROI for final expense leads?

Effective strategies include segmenting leads for targeted marketing, utilizing multi-touchpoint engagement, investing in automation for lead nurturing, focusing on lead quality over quantity, and continuously monitoring and optimizing the sales funnel.

How can automation improve ROI in final expense lead generation?

Automation streamlines repetitive tasks like follow-up communications, ensuring timely and personalized engagement with leads. This efficiency saves time, reduces manual errors, and maintains consistent contact, all contributing to improved conversion rates and higher ROI.