The Affordable Care Act (ACA) has dramatically reshaped the health insurance landscape in the United States, offering health coverage to millions who were previously uninsured. In 2024, the ACA continues to play a pivotal role in the nation’s health insurance market. According to the Centers for Medicare and Medicaid Services (CMS), over 14.5 million people enrolled in health insurance plans through the ACA marketplace for the 2024 coverage year which is a significant increase compared to previous years. This growing demand presents an ongoing opportunity for insurance agents, making ACA leads more valuable than ever.

Insurance agents must adapt to this evolving market by leveraging ACA leads, a key strategy for expanding their business and increasing revenue. ACA leads provide agents access to a high-demand market, offering them a chance to tap into a wide range of potential clients who are actively seeking coverage.

This article delves into why ACA leads are crucial for insurance agents and how they can unlock success through these opportunities.

Key Takeaways:

- ACA leads offer agents access to a growing market with millions of potential clients.

- Targeted leads result in higher conversion rates and improved ROI.

- Agents can play a crucial role in educating prospects and guiding them through the complex ACA enrollment process.

- Open Enrollment periods represent a prime opportunity for agents to grow their client base.

- ACA leads help diversify client portfolios, creating opportunities for cross-selling other insurance products.

- Cost-effective marketing strategies make ACA leads a smart investment for agents looking to optimize their marketing budget.

Table of Contents

Understanding ACA Leads:

ACA leads refer to potential clients who are interested in purchasing health insurance through the ACA Marketplace. These individuals may be seeking coverage for various reasons, such as changes in employment, family status, or income levels. ACA leads are valuable because they represent prospects who are actively looking for health coverage, making them more likely to convert into sales compared to traditional cold leads.

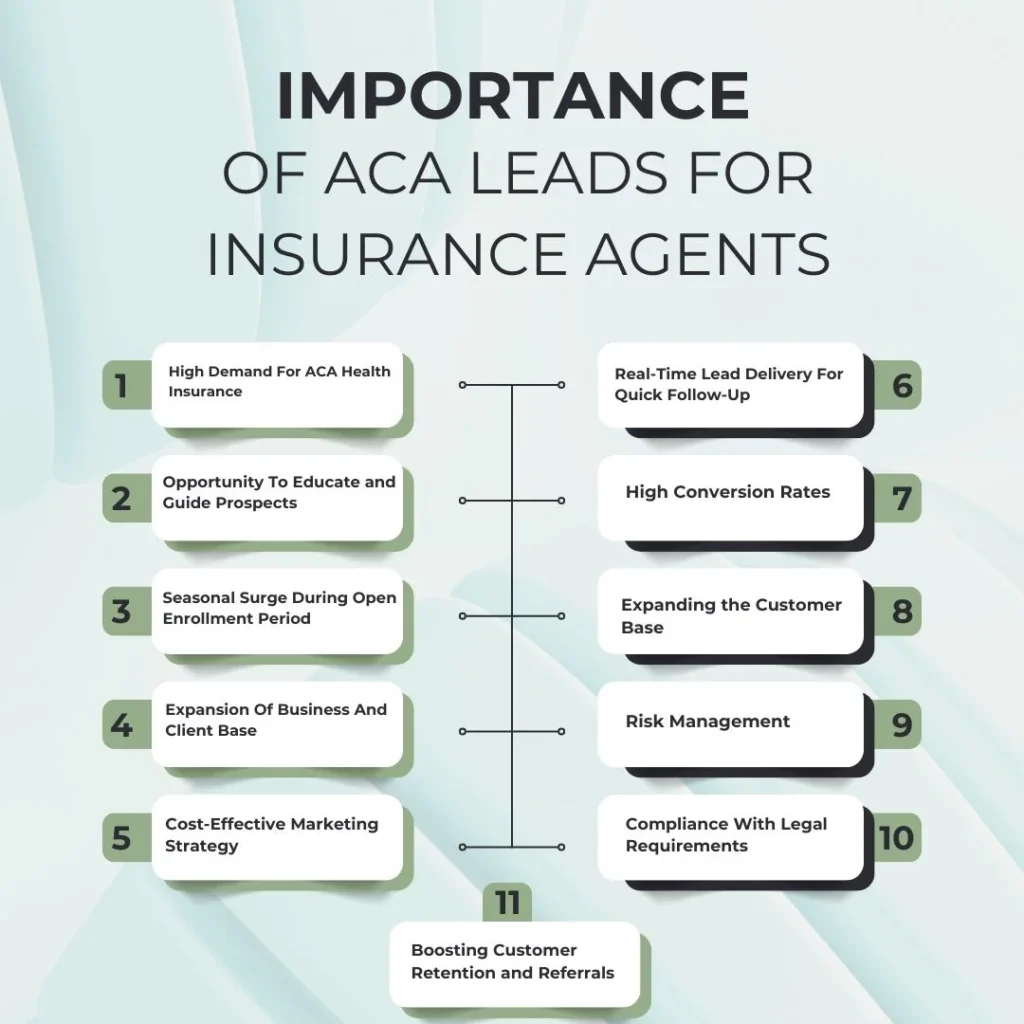

Why ACA Leads Are Crucial For Insurance Agents? Reasons Revealed

The Affordable Care Act (ACA), also known as Obamacare, has transformed the health insurance landscape in the United States. With millions of Americans seeking health coverage through the AC marketplace, there is a significant opportunity for insurance agents to grow their business. ACA leads prospective clients who have shown interest in obtaining health insurance through the marketplace to play a crucial role in this growth. Understanding the importance of ACA leads can help insurance agents maximize their sales efforts, streamline their marketing strategies, and ultimately increase revenue.

1. High Demand For ACA Health Insurance:

As of 2024, over 14.5 million people are enrolled in ACA plans, continuing a steady increase in enrollment. This demand provides agents with a consistent flow of leads actively seeking affordable health insurance. The ACA has made health coverage accessible to millions of Americans, creating a substantial market for insurance agents to tap into.

2. Opportunity To Educate and Guide Prospects:

Many individuals struggle to navigate the complexities of ACA enrollment, with various plans and eligibility criteria to consider. ACA leads present a unique opportunity for agents to educate and guide prospects through the enrollment process. Agents can offer personalized support, building trust and fostering long-term relationships with clients. This guidance improves conversion rates and enhances client retention.

3. Seasonal Surge During Open Enrollment Period:

The Open Enrollment Period (OEP), which runs annually, sees a massive surge in interest from individuals seeking health insurance. During OEP, millions of people are actively looking to enroll in ACA plans. Insurance agents can take advantage of this surge by focusing on ACA leads during this time to maximize conversions and secure more policies in a short window.

4. Expansion Of Business And Client Base:

ACA leads allow agents to reach a diverse audience, including young adults, low-income families, and self-employed individuals. This diversity helps expand agents’ client bases, creating opportunities for cross-selling additional insurance products such as life insurance or dental coverage, thereby increasing overall revenue.

5. Cost-Effective Marketing Strategy:

With targeted ACA leads, insurance agents can focus their marketing budgets on high-quality prospects, reducing waste and maximizing ROI. Lead generation companies often offer flexible payment models, such as cost-per-lead (CPL) or cost-per-acquisition (CPA) pricing, allowing agents to optimize their marketing expenses.

6. Real-Time Lead Delivery For Quick Follow-Up:

Timing is crucial when it comes to converting leads into clients. ACA leads are often delivered in real-time, allowing insurance agents to reach out to prospects shortly after they express interest in obtaining coverage. Quick follow-up increases the chances of converting leads, as the prospect’s interest is still fresh, and they are more likely to engage in a meaningful conversation. Real-time lead delivery helps agents stay ahead of the competition and ensures that they can capitalize on opportunities as they arise.

7. High Conversion Rates:

ACA leads are typically more qualified than general health insurance leads. The individuals seeking ACA coverage are motivated to find affordable health insurance options, especially during open enrollment periods. This motivation increases the likelihood of conversion, resulting in a higher return on investment (ROI) for insurance agents. By focusing on ACA leads, agents can maximize their efforts and close more deals, leading to increased revenue.

8. Expanding the Customer Base:

The ACA mandates that nearly all Americans have health insurance, which has significantly expanded the pool of potential clients. As millions of people search for affordable coverage options, insurance agents have a unique opportunity to tap into this market. ACA leads allow agents to grow their customer base, providing a steady stream of prospects to nurture and convert into long-term clients.

9. Compliance With Legal Requirements:

The ACA imposes strict regulations on health insurance providers and agents, including the need to offer compliant plans. Working with ACA leads ensures that agents are promoting insurance plans that meet legal requirements. By targeting ACA leads, agents can stay on the right side of the law while offering valuable services that meet clients’ needs.

10. Steady Demand During Open Enrollment Periods:

One of the key advantages of ACA leads is the consistent demand during the ACA open enrollment period (OEP) and special enrollment periods (SEP). During these times, individuals actively seek health insurance, making it easier for agents to find prospects interested in ACA plans. The recurring nature of these enrollment periods guarantees a predictable surge in demand, allowing agents to plan their marketing and sales strategies accordingly.

11. Boosting Customer Retention and Referrals:

When agents focus on ACA leads, they can build lasting relationships with clients who appreciate the guidance and support in navigating the complex health insurance landscape. Satisfied clients are more likely to renew their policies, which boosts customer retention rates. Additionally, they may refer friends and family members, providing agents with new leads and expanding their network without additional marketing expenses.

How To Unlock Success With ACA Leads?

1. Target the Right Demographics:

To maximize success, agents must target the right demographics, such as individuals without employer-provided insurance, young adults, and low-income families. Tailoring marketing messages to these groups will increase engagement and improve conversion rates.

2. Leverage Technology and Data:

Using CRM systems, predictive analytics, and lead management platforms can help agents segment leads and prioritize high-quality prospects, making their marketing efforts more efficient and effective.

3. Offer Personalized Consultations:

Navigating the ACA Marketplace can be daunting for many individuals. By offering personalized consultations, agents can add value and differentiate themselves from competitors. Providing clear, step-by-step guidance on selecting the right ACA plan can help build trust and establish the agent as a reliable resource, increasing the chances of closing deals.

4. Emphasize the Benefits of ACA Plans:

Agents should educate prospects on the benefits of ACA plans, such as essential health benefits, subsidies, and tax credits that can lower premium costs. Demonstrating the value of ACA coverage can motivate leads to take action, making them more likely to choose an ACA plan through the agent.

5. Partner with Lead Generation Companies:

For agents who want to maximize their time, partnering with a reputable lead generation company can provide a consistent flow of high-quality ACA leads. These companies specialize in identifying prospects who meet the ACA criteria, enabling agents to focus on selling rather than searching for potential clients. Working with a lead generation company can save time and ensure a steady stream of qualified leads.

Conclusion – Why ACA Leads Are Crucial For Insurance Agents?

ACA leads are crucial for insurance agents looking to grow their business, maximize conversion rates, and expand their client base. By targeting specific audiences, taking advantage of seasonal surges, and leveraging cost-effective marketing strategies, agents can unlock new opportunities in the ACA marketplace. Additionally, offering expert guidance to prospects builds trust, enhances client retention, and establishes agents as reliable advisors.

FAQ’s:

What are ACA leads?

ACA leads are individuals seeking health coverage through the Affordable Care Act Marketplace. They are highly motivated to enroll in health plans, making them valuable for insurance agents.

Why should insurance agents focus on ACA leads?

Focusing on ACA leads provides insurance agents access to a large, motivated client base, resulting in higher conversion rates, cost-effective marketing, and opportunities for business growth.