In 2024, the final expense insurance market is projected to reach approximately $188.26 billion, with expectations to grow at a compound annual growth rate (CAGR) of 7.1% through 2032. This growth underscores the increasing importance of final expense leads for insurance professionals aiming to meet the rising demand for end-of-life financial planning.

This blog will explore the details, what are final expense leads, and their importance in the insurance industry, and offer strategies for effectively generating final expense leads.

Key Takeaways:

- Final expense leads are critical for covering end-of-life costs, with high demand driven by an aging population.

- Exclusive leads ensure higher conversion rates, while shared and aged leads offer cost-effective alternatives.

- Effective lead generation strategies include Facebook ads, direct mail, and telemarketing, among others.

- Quick responses, personalized communication, and educational resources increase lead conversion success.

- Leverage tools like CRM systems and automated workflows for efficient lead management.

Table of Contents

What Are Final Expense Leads?

Final expense leads refer to potential clients interested in insurance policies designed to cover end-of-life expenses, such as funeral costs, medical bills, and other related charges. These leads typically consist of individuals over 50 years old seeking financial solutions to prevent their loved ones from bearing the financial burden of their passing.

Understanding Exclusive Final Expense Leads:

Exclusive final expense leads are prospects sold to a single agent or agency, ensuring no competition in reaching out to the potential client. While these leads are generally more expensive, they offer a higher conversion rate due to the exclusivity of contact.

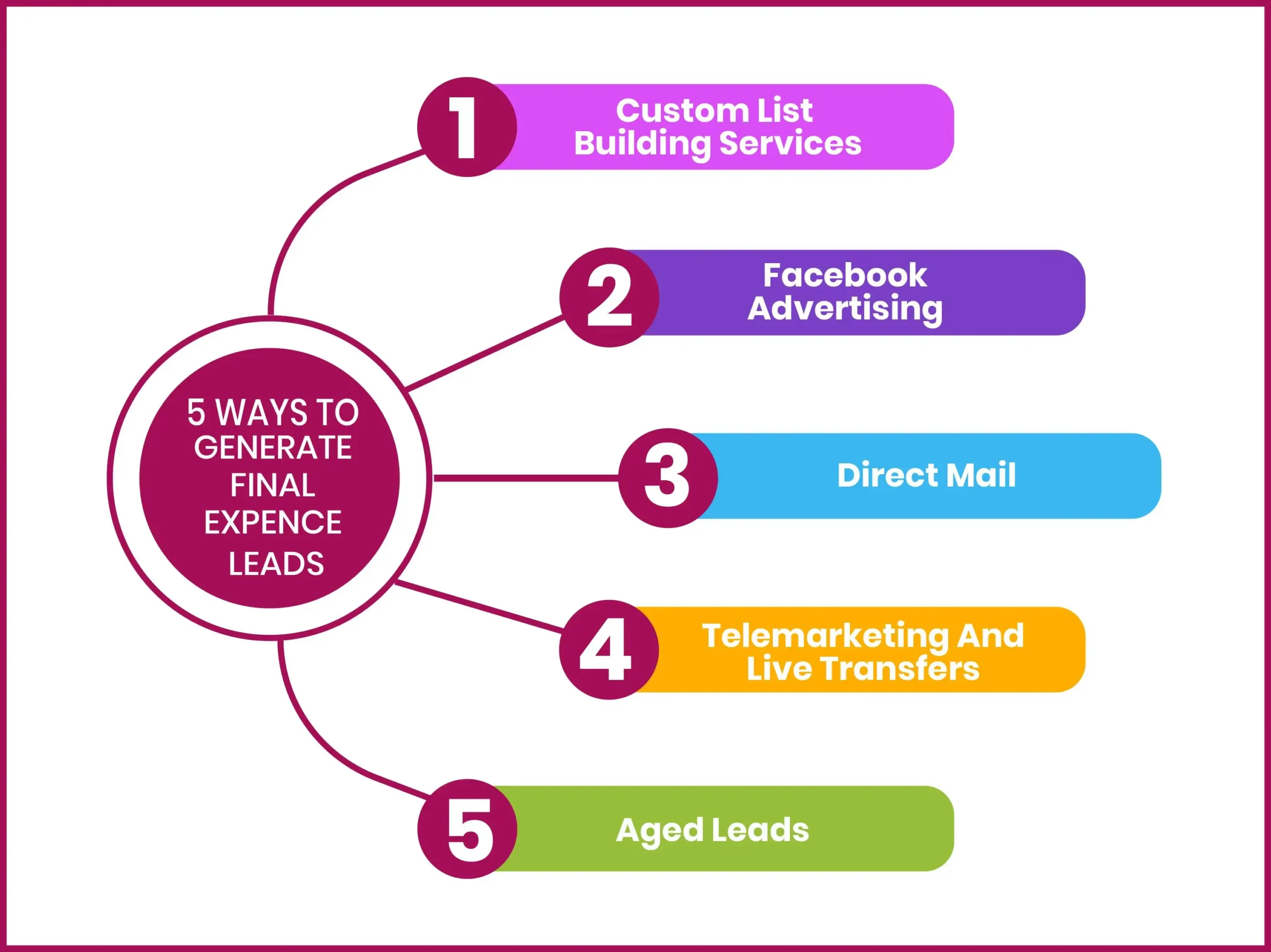

How To Generate Final Expense Leads In 5 Steps:

Generating high-quality final expense leads involves multiple approaches.

Here are five effective methods:

1. Custom List Building Services:

Utilizing custom list-building services allows agents to target specific demographics, such as age, income level, and geographic location, to identify individuals likely interested in final expense insurance. This targeted approach increases the likelihood of conversion.

2. Facebook Advertising:

Get back to basics but with more sophistry via a targeted advertisement on social media specifically Facebook. When the targeted students in the filtered demographic area and age of the intended college are reached, they get the advertisement on the news feeds of the targeted clients such that the advertisement is placed where the potential client spends most of his/her time.

3. Direct Mail:

Craft tailored mailers specifically designed to resonate with your chosen audience segments. Ensure that your mailers feature captivating calls to action and provide clear and convenient methods for recipients to get in touch with your business.

4. Telemarketing and Live Transfers:

Care must be taken to ensure that the telemarketing is done with a lot of courtesy and within the do not call list legislation assured, the response shall always be instant. Oh really? Well, let alone utilizing an autoresponder to guide interested prospects to your webpage you can be paid live transfer leads to guide the prospect to you in real-time.

5. Aged Leads:

Aged leads are older prospects that were not converted at the time of initial contact. They are more affordable and, with a structured follow-up strategy, can still yield successful conversions. Implementing tools like Customer Relationship Management (CRM) systems and dialers can enhance outreach efficiency.

Different Types of Final Expense Leads:

The world of final expense leads can feel overwhelming at first but don’t worry. Understanding the different types of leads available can significantly streamline your sales process. Let’s explore some key variations to help you choose the options that best fuel your sales pipeline.

There are several types of final expense leads that insurance agents and companies typically work with:

1. Exclusive Final Expense Leads:

These leads are sold to only one agent or agency, ensuring that the buyer is the only one contacting the potential customer. Exclusive leads are generally more expensive but have a higher conversion rate due to the lack of competition.

2. Shared Final Expense Leads:

These leads are sold to multiple agents or agencies, meaning that the potential customer may be contacted by several different companies. While shared leads are less expensive, they often result in lower conversion rates due to the increased competition.

3. Aged Final Expense Leads:

Aged leads are older leads that were generated days, weeks, or even months ago. While they are cheaper, the likelihood of conversion decreases as time passes since the lead may have already purchased insurance or lost interest.

4. Telemarketing Final Expense Leads:

These leads are generated through outbound call campaigns. Agents or telemarketers call potential customers to gauge their interest in final expense insurance and gather their contact information for follow-up.

5. Internet Final Expense Leads:

Generated online, these leads come from individuals who have filled out a form or expressed interest in final expense insurance via a website, social media, or online advertisements. Internet leads can be highly valuable due to the active interest shown by the prospect.

6. Direct Mail Final Expense Leads:

These leads are generated through direct mail campaigns, where potential customers receive brochures or flyers about final expense insurance. They can express their interest by returning a form or calling a dedicated phone number.

The Importance of Final Expense Leads:

For insurance agents and companies, final expense leads are the lifeblood of their business. The profitability of an insurance business often hinges on the quality and quantity of leads it can generate and convert.

Here’s why final expense leads are so important.

1. High Demand:

With the aging population, particularly in developed countries, the demand for final expense insurance is growing. Seniors are increasingly looking for ways to secure their families’ financial future, making this a lucrative market.

2. Recurring Revenue:

Final expense insurance policies often result in long-term customer relationships. Once a policy is sold, it typically generates recurring revenue through monthly or annual premiums.

3. Cross-Selling Opportunities:

Acquiring final expense leads provides insurance agents with opportunities to cross-sell other types of insurance products, such as health insurance, life insurance, or annuities.

4. Customer Loyalty:

Final expense insurance buyers tend to be loyal customers. As they age, they may require additional insurance products, creating opportunities for agents to build long-term relationships and secure future sales.

Best Practices For Final Expense Leads Conversion:

Acquiring leads is only half the battle. The real challenge lies in converting those leads into customers. Here are some best practices for maximizing your conversion rates:

1. Speed To Contact:

The faster you reach out to a lead after they express interest, the higher your chances of conversion. Prompt follow-up shows the customer that you are responsive and reliable.

2. Personalized Communication:

Tailor your communication to the specific needs and concerns of each lead. Seniors often have different priorities when it comes to final expense insurance, so understanding and addressing those needs is crucial.

3. Educate:

Don’t Just Sell: Many potential customers may not fully understand what final expense insurance covers or how it benefits them. Take the time to educate them, which can build trust and make them more likely to purchase.

4. Consistent Follow-Up:

Not all leads will convert on the first contact. Regular follow-up, without being overly aggressive, is essential. Use a mix of phone calls, emails, and even direct mail to stay top of mind.

5. Leverage Technology:

Utilize customer relationship management (CRM) tools to keep track of leads, manage follow-ups, and analyze data. This can help you refine your approach and improve conversion rates over time.

Conclusion – What Are Final Expense Leads:

Final expense leads remain an indispensable element of success in the insurance sector. With the aging global population, particularly in developed countries, the demand for such insurance continues to rise. By understanding the various types of final expense leads, utilizing effective generation methods, and employing best practices for conversion, agents can secure high-quality prospects and achieve sustained growth.

In 2024 and beyond, embracing a tech-savvy approach, combined with targeted marketing and personalized communication, will be key to staying competitive. Whether it’s exclusive leads or Facebook-generated prospects, the strategies highlighted here will help you make the most of your final expense lead campaigns.

FREQUENTLY ASKED QUESTIONS:

How to generate leads for final expense?

Generating final expense leads involves targeted strategies like:

Facebook ads: Use demographic filters for a focused audience.

Direct mail campaigns: Personalized mailers resonate with recipients.

Telemarketing: Real-time engagement boosts interest.

How much does a final expense lead cost?

Final expense lead costs vary by type:

Exclusive leads: $20–$50 per lead.

Shared leads: $10–$15 per lead.

Aged leads: As low as $3 per lead, depending on their age.