In 2024, the global final expense insurance market is projected to reach approximately $188.26 billion, with expectations to grow at a 7.1% CAGR, reaching about $350.44 billion by 2032. This significant growth underscores the increasing demand for final expense insurance products.

For insurance agents, aged final expense leads present a cost-effective opportunity to tap into this expanding market. These leads allow agents to connect with prospects who initially showed interest in final expense insurance, but success depends on proper follow-up strategies to convert these leads into clients.

Are aged leads worth it?

Yes, aged leads are cost-effective, offering agents opportunities to connect with prospects who initially showed interest in final expense insurance. With proper follow-up strategies, these leads can be successfully converted into clients.

This article delves into the pros and cons of aged final expense leads, their associated costs, and best practices for maximizing their potential in today’s competitive landscape.

Key Takeaways:

- Aged final expense leads are cost-effective, providing a budget-friendly option for insurance agents to expand their client base.

- These leads come with reduced competition, offering agents a higher chance of engaging with prospects.

- Personalized outreach and multi-channel communication significantly enhance the likelihood of conversions.

- Challenges such as outdated information can be addressed using effective data validation tools.

- Successful strategies include automation, content marketing, and offering incentives to drive engagement and conversions.

Table of Contents

Understanding Aged Final Expense:

Best Final expense leads that are aged offer a valuable opportunity for insurance agents looking to generate qualified leads cost-effectively. These leads are typically 30 days or older and have been previously contacted by other agents but have not yet purchased a final expense policy. Engaging with these leads provides agents with the chance to offer a tailored solution and valuable guidance to potential clients who may still be exploring their options.

Key Characteristics of Aged Final Expense Leads:

- Time-Lapse: The primary method of defining aged leads is to look at the amount of time that has elapsed from the time that specific leads were created. Depending on the marketing plan, it can be different, but usually, such a long time indicates that the leads are no longer very active.

- Cost-Effective: Older leads are cheaper compared to fresh leads, and it could be a sign that the company is trying to offload the old stock of the leads. This cost reduction can help agents buy more leads as compared to the past within the same amount of money.

- Potential for Interest: In this case, one needs to note that despite the leads being rather old, they initially showed some level of interest in final expense insurance. It is quite probable that many prospects may still require the coverage and can be willing to be engaged once again.

- Reduced Competition: New leads are chased by many agents, which results in increased competition. On the other hand, aged leads are much less competitive meaning that the agent will have a better chance of making a connection.

Why Use Aged Final Expense Leads?

Aged leads offer insurance agents a chance to reach a broader audience without breaking the bank. With innovative follow-up strategies and tools, these leads can deliver excellent returns for a fraction of the cost of fresh leads.

Things To Consider When Buying Aged Final Expense Leads:

- Lead Quality: It is a very debatable topic since aged leads can be good and aged leads can also be bad. Some of the leads might probably be in a better position to make the decision and buy the insurance policy while others may not be interested at all or have probably purchased an insurance policy.

- Timeliness: Ideally, aged leads should be called as soon as one gets hold of it or within the day depending on the hour of receipt, or at most within a week. Thus, the longer the users remain in this state without engaging with it, the farther from a conversion they are and the colder they become.

- Follow-Up Strategy: Ensure that the follow-up plan is well formulated in a way that, will enable the call and converse with the leads severally to sell them final expense insurance.

Innovative Strategies For Converting Aged Leads Final Expense:

To maximize the potential of aged final expense leads, agents need to adopt innovative approaches. Here are some effective strategies:

- Data Cleansing and Enrichment: Update contact details using tools like Experian or CRM software.

- Personalized Outreach: Reference prior interactions and offer tailored solutions.

- Multi-Channel Communication: Utilize phone calls, emails, and social media to connect effectively.

- Re-Engagement Campaigns: Run targeted promotions or share success stories to rebuild interest.

- Leverage Automation: Automate follow-ups and reminders for efficiency using tools like HubSpot.

- Build Trust Through Content: Share informative blogs or videos to establish credibility.

- Offer Incentives: Provide discounts or limited-time offers to encourage immediate action.

- Track Results: Use analytics to monitor conversion rates and adjust strategies.

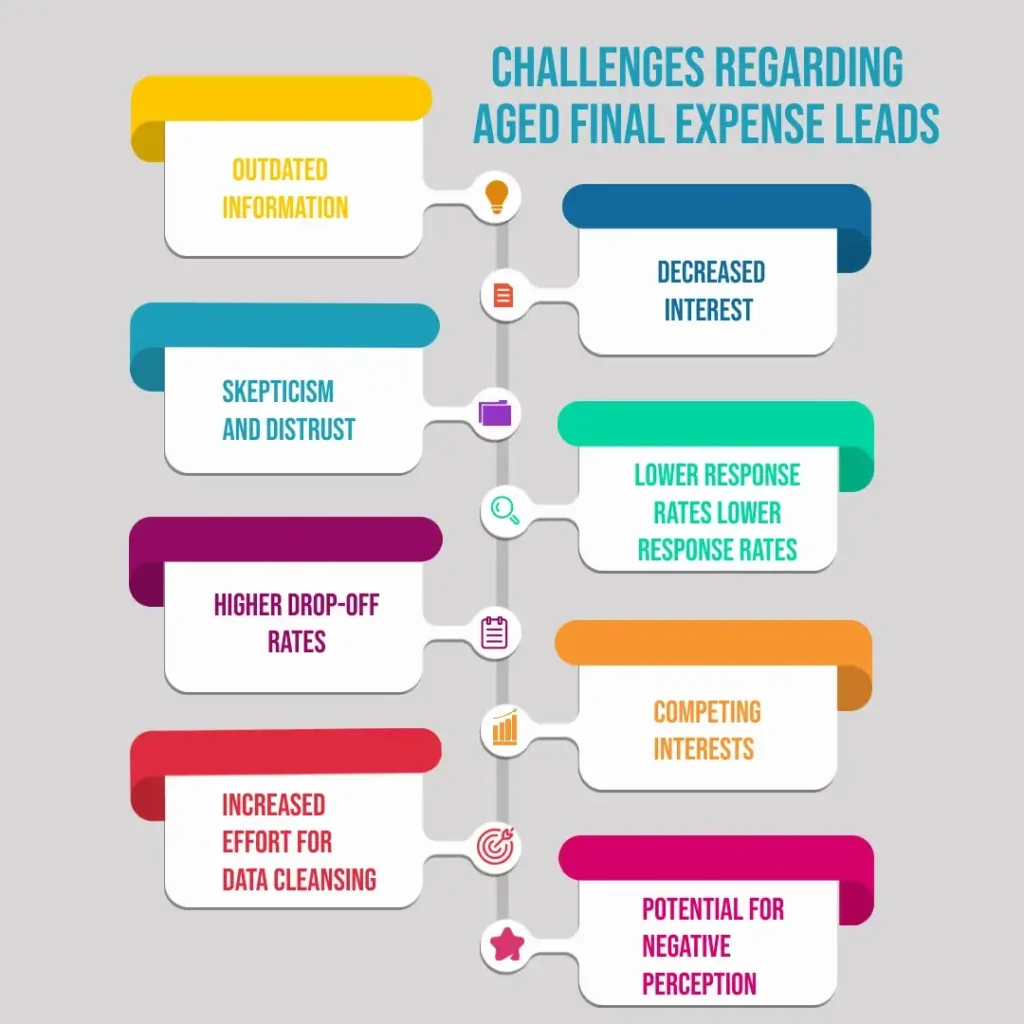

Challenges Regarding Aged Final Expense Leads:

While aged final expense leads can offer opportunities for cost-effective customer acquisition, they also come with a set of challenges that agents must navigate to achieve successful conversions. Here are the key challenges:

- Outdated Information: Use data validation tools to ensure accuracy.

- Decreased Interest: Implement re-engagement campaigns to rekindle interest.

- Skepticism and Distrust: Build rapport through positive communication.

- Lower Response Rates: Increase efficiency with automation and broader outreach.

- Higher Drop-Off Rates: Maintain regular follow-ups to keep prospects engaged.

- Competing Interests: Highlight benefits specific to their current needs.

Where To Find Aged Final Expense Leads?

- Lead aggregator platforms: Several online platforms specialize in providing free aged leads for final expense insurance.

- Direct mail marketing companies: Some companies offer aged leads generated through targeted direct mail campaigns.

- Insurance marketing agencies: Many agencies offer aged leads as part of their comprehensive marketing services for insurance agents.

Tools and Software For Managing Aged Leads:

To effectively manage and convert aged final expense leads, leveraging the right tools and software is crucial. Here are some innovative solutions:

1. CRM Systems:

Salesforce, Zoho CRM, and HubSpot are examples of Customer Relationship Management (CRM) that can assist you in this process of lead organization and management. These include lead score, follow-up automation, and analyzation amongst other complementary tools.

2. Data Validation Tools:

Applications like Experian Data Quality and Melissa Data can be used to clean the contact information so that when you are targeting your prospects, you are targeting the right one.

3. Email Marketing Platforms:

Mail chimp and ActiveCampaign for example enable you to craft targeted emails, follow-up without having to conduct them manually, and know the level of engagement from users.

4. Dialing Software:

As for calling, there are Five9 and RingCentral, which will help to call automatically, record the calls, and connect with the CRM.

5. Social Media Management Tools:

Applications such as Hootsuite and Buffer can be of assistance in performing the social media communication strategy, as well as in posting activities screened and organizing engagement with potential clients on the platforms they use most often.

Conclusion – Aged Final Expense Leads:

Aged final expense leads can be a powerful tool for insurance agents looking to expand their client base cost-effectively. By understanding their characteristics, leveraging the right tools, and implementing innovative strategies, agents can turn these aged prospects into long-term clients. With automation tools, personalized outreach, and consistent follow-ups, agents can ensure success in the competitive life insurance market of 2024 and beyond.