In the competitive world of insurance sales, leads are critical to a business’s success. For agents and brokers focusing on Affordable Care Act (ACA) health plans, ACA leads represent individuals and families seeking health coverage through the ACA marketplace. With the ever-growing demand for healthcare coverage, ACA leads are expected to remain a vital source of business in 2024. The ACA marketplace has seen increased enrollment, with more than 16.3 million people signing up for 2024 health plans as of January 2024, a 5% increase from the previous year.

The ongoing need for affordable healthcare is a driving force behind this surge, and it is anticipated that future trends will continue to demonstrate strong growth, with projections showing an additional 5-7 million individuals gaining health insurance coverage in the next few years as subsidies and policy adjustments remain accessible.

This article thoroughly explores Affordable Care Act leads, covering their benefits, drawbacks, strategies for generating them, and tips for maximizing their value in your business.

Key Takeaways:

- ACA leads remain in high demand in 2024, offering opportunities to agents with strategic outreach.

- High competition for ACA leads requires fast action and clear communication.

- Content marketing and paid lead services can help generate and convert ACA leads effectively.

- Government subsidies make ACA plans more affordable, which simplifies the sales process for agents.

- Building strong relationships through personalized communication ensures long-term client retention and recurring commissions.

Table of Contents

What Are Affordable Care Act Leads?

ACA leads are contacts or individuals who have expressed interest in purchasing health insurance through the Affordable Care Act’s Health Insurance Marketplace. These leads are typically generated during open enrollment periods when people are most likely to explore their healthcare options. The leads may include individuals who are:

- Uninsured and need coverage,

- Looking for more affordable health plans,

- Losing their current coverage due to job changes or other qualifying life events,

- Families or individuals who qualify for government subsidies to reduce health insurance costs.

These leads may come from direct inquiries, referrals, or purchased from third-party vendors. Key details typically included in ACA leads are name, contact information, age, household size, and income level, which are essential for determining eligibility for various plans and subsidies.

Related: ACA Live Transfer Leads | A Complete Guide

Benefits Of The ACA Insurance Leads:

- High Demand: ACA leads are valuable because health insurance is a necessity for most people. The Affordable Care Act’s mandate requires most individuals to have health coverage, creating a consistent demand for insurance agents and brokers who specialize in ACA plans.

- Targeted Audience: ACA leads represent individuals actively seeking coverage, often with a clear understanding of their need for health insurance. This means you’re working with a more engaged and motivated audience, which can improve conversion rates.

- Opportunities for Cross-Selling: ACA leads can open doors to selling other insurance products such as dental, vision, life, or supplemental health plans. Cross-selling allows agents to increase their revenue and provide comprehensive coverage for clients.

- Government Subsidies: Many individuals seeking ACA coverage qualify for government subsidies or premium tax credits, making health plans more affordable. This affordability factor can make it easier to close sales and retain clients long-term.

- Recurring Revenue: Many ACA plans renew annually, offering agents the opportunity to build relationships with clients and benefit from recurring commissions. This steady income stream is a significant advantage for insurance agents focused on ACA plans.

Drawbacks Of The Affordable Care Act Leads:

- Seasonality: ACA leads tend to be concentrated around the open enrollment period, which usually occurs once a year. This seasonality can lead to fluctuations in lead volume, making it essential for agents to plan their outreach and ACA sales strategies accordingly.

- High Competition: ACA leads are highly sought after, and there is often significant competition among agents, brokers, and insurance companies. This competition can drive up the cost of paid leads and make it challenging to stand out in a crowded market.

- Lead Quality: Not all ACA leads are created equal. Some leads may be incomplete, outdated, or unresponsive. Ensuring that you’re working with high-quality leads, especially if you’re purchasing them from a third-party vendor, is crucial to your sales efforts.

- Price Sensitivity: ACA shoppers tend to be price-conscious, especially those who qualify for subsidies. As a result, many clients may prioritize lower-cost plans, which can limit opportunities for upselling or generating higher commissions.

- Compliance Challenges: ACA plans are subject to specific rules and regulations. Agents need to stay updated on compliance requirements, including marketing practices and licensing, to avoid potential legal or financial repercussions.

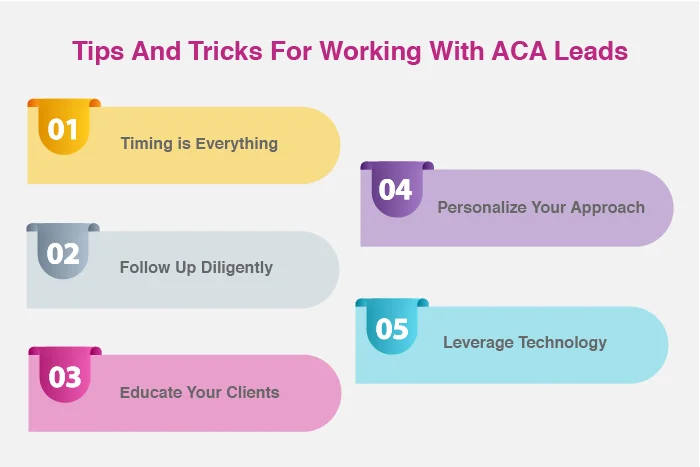

Tips and Tricks For Working With Obamacare Leads:

- Act Quickly: Timing is crucial—ACA leads are most valuable during the open enrollment period. Responding within 24 hours increases your chances of conversion.

- Diligent Follow-Up: Some leads may require multiple follow-ups to close. Using a mix of phone calls, emails, and texts helps keep you top-of-mind.

- Educate Clients: Many potential ACA clients lack understanding about plans, subsidies, and enrollment processes. Offering educational resources and answering questions enhances your credibility.

- Personalized Outreach: Tailor your recommendations based on individual needs, including health status, income, and household size. Personalization builds trust and improves conversion rates.

- Leverage Technology: Use CRM tools to track and manage ACA leads effectively, ensuring you don’t miss an opportunity and can follow up efficiently.

How To Generate Affordable Care Act Leads?

- Paid Lead Services: One of the most effective ways to obtain ACA leads is through paid lead services. These vendors can provide targeted leads based on factors like location, income, and household size.

- Content Marketing: Creating informative content, such as blogs or videos on how to choose the right ACA plan, can organically attract potential ACA clients.

- Email Marketing: Build an email list to engage leads throughout the year, providing them with updates on policy changes, tips, and reminders for open enrollment.

- Referrals: Encourage client referrals by offering incentives or bonuses. Happy customers often share your services with friends and family.

- Social Media Advertising: Platforms like Facebook and Instagram provide advanced targeting capabilities, allowing you to reach ACA-eligible individuals through well-crafted ads.

- Local Partnerships: Collaborating with local healthcare providers and community organizations can help you connect with individuals seeking coverage in your area.

Conclusion – Affordable Care Act Leads:

The Affordable Care Act offers critical resources for individuals seeking affordable health insurance coverage. In 2024, with millions of people continuing to benefit from subsidies and open enrollment options, ACA leads remain a highly valuable source of business for insurance agents. However, to successfully convert ACA leads into clients, agents must be prepared to act quickly, follow up diligently, and provide a personalized, educational approach to each prospect. By leveraging strategies like paid lead services, content marketing, and referrals, agents can build a steady pipeline of high-quality ACA leads and expand their business in the competitive health insurance market.

FAQ’s:

Are ACA leads competitive?

Yes, ACA leads are highly competitive, especially during the open enrollment period. Agents must act fast and maintain strong follow-up practices to convert leads into clients.